Last month we published our Annual Report which highlights the work we carried out in 2018 along with a detailed breakdown of our financial performance.

Things have remained stable

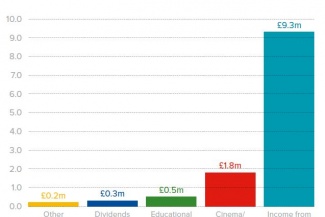

The headline numbers remain consistent with 2017 and our *group turnover remains in line with the previous year at £12.2m. When this is broken down, £9.6m came from investing activities, the vast majority of this being from investment properties. A further £2.5m came from charitable activities, primarily Broadway Cinema & Theatre and Standalone Farm.

*Our group includes The Foundation, Garden Cities Technologies Ltd and Letchworth Cottages and Buildings Ltd.

Our investments performed well

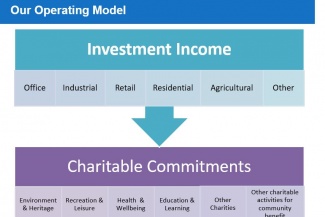

Seventy seven percent (£9.6m) of our income came from our investments. £4.48m was spent maintaining and managing our property portfolio, which includes offices, industrial units, residential and retail units. Maintaining our portfolio means they are more desirable for people to let or lease.

Overall, we generated a net return from investing activities of £5.14m. This is a key figure for the organisation as this is the amount we can invest in our charitable services (unless our Trustees agree to use cash from other sources).

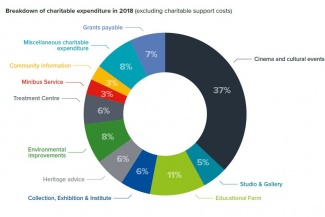

Our charitable activities are diverse

These range from running Broadway Cinema, Theatre, Gallery and Standalone Farm, to the Ernest Gardiner Treatment Centre and the Garden City Collection. It also includes our free minibus service and our Grants Programme which awarded more than £400,000 in grants during 2018. In total, £5.18m was spent on our charitable activities, including our venues and strategic programmes such as Active Letchworth, cultural learning with schools and our families and young people’s project.

With £5.14 made from investments and £5.18m (net) being spent on charitable activities, this means there was a deficit of £40k (i.e. broadly breakeven).

Our property portfolio has increased in value

Our biggest asset is our property portfolio and this has performed well, increasing in value from £157m in 2017 to £164m in 2018. While this is good news, it’s just a valuation and doesn’t mean there is extra money in the bank.

Empty properties are costly

While empty units represent a small percentage of our portfolio (7%) they are a key focus for us. There are many reasons for this, but the financial impact is significant, due to a combination of lost income, additional landlord management and maintenance costs.

Introducing Gift Aid

We have made the most of our charitable status by introducing Gift Aid at Standalone Farm. We aim to use the money generated to reinvest back into the farm to improve the customer experience.

In summary

2018 has been a steady year with no significant changes from 2017. Our return from investments generated £5.1m. Our venues generated income of £2.5m and overall we have spent £7.7m on our charitable activities.